By Isabella Bloom, Ethnic Media Services

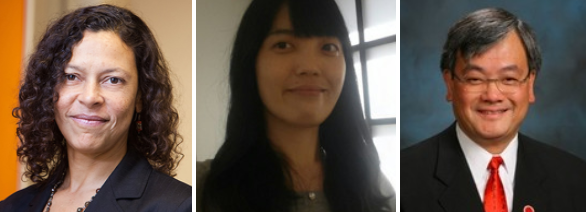

Jie Wang owns three rental homes in Oakland. Her entire family depends on the income from the tenants who pay her rent.

Many have lost their jobs during the pandemic. The moratoriums on evictions protect tenants who can't pay some or all of their rent. But small housing providers, like Wang, still have to pay mortgages, utilities and other expenses. The lack of government support has created pressure on them to sell their properties.

"No one can escape this coronavirus," Wang said. "I have a very good relationship with all my tenants. I try to help them."

Wang participated in a recent informational panel organized by Ethnic Media Services along with other housing rights advocates and housing rights researchers. The panel had a discussion about the risk of treating all landlords the same.

When talking about the "property owner" many people usually think of large real estate corporations, owners of many real estate investment properties, wealthy enough to hold on to their properties during the pandemic. However, the small private owners The loss of income of rental housing owners, who are also called "private landlords" or "small landlords", has been hard hit as tenants have been unable to pay their rent during the pandemic, at least partially.

According to the Urban Institute, individual investors like Wang, not large conglomerates, own more than 75% of 1- to 4-unit rental properties. In addition, it is common for private landlords of color to own two-, three-, or four-family properties.

Their rental rates tend to be cheaper, so they are more likely to attract minority tenants.

Maeve Brown is the executive director and founder of Housing and Economic Rights Advocates (Housing and Economic Rights Advocates), a statewide nonprofit law firm that provides free legal services to low- and moderate-income Californians. It works with many people of color who have never received training on how to manage their properties and who usually charge below-market rents.

"Another key part of the story is our failure to understand and appreciate what small homeowners are really offering: our failure to recognize that they really are affordable housing providers," Brown said. "If localities and our state government frankly recognized the reality of that situation, then that should have an impact on the policy decisions they make."

Small private landlords tend to be more connected to their communities and tenants.

John Wong, founding president of Asian Real Estate Association of AmericaJohn has lived in San Francisco for almost 67 years and has been a real estate agent for over 40 years. At the briefing, John described the relationships he has had and observed between private landlords and their tenants.

"I talk about this group of housing providers because I think it has to do with our response to COVID," Wong said.

He added that private landlords often know their tenants personally.

"The relationships are usually very, very friendly," he said.

Rental assistance programmes, such as the $2 trillion CARES ActThe new laws have mainly benefited the largest and richest real estate companies, leaving aside private property owners.

"The policy choices the state has made have not distinguished between large corporations and small landlords," Brown said. "The state's policy choices have directly placed the burden of non-payment of rent squarely on the shoulders of small private landlords, who are the small providers of affordable housing."

The danger of allowing that cost to fall on homeownership providers is that it puts pressure on them to sell their properties to corporate investors and real estate conglomerates. The result is that California will lose more and more affordable housing.

"If they lose their property, they'll probably lose it to a corporate investor who will charge as much money as the market will bear," Brown said.

Homeowners of color are also more likely to have a mortgage and lower incomes, so the pressure to sell during the pandemic is greater, according to the Urban Institute.

There may be new hope for private landlords and their tenants through a new rental assistance program, but it comes with a caveat.

California's new rental assistance program to help the state's most vulnerable renters and homeowners opened on March 15. The program, which comes from the Senate Bill SB 91extends the moratorium on evictions until June 30 and allocates $$2.6 billion in federal funds for rental assistance.

"The SB 91 moratorium and the state's rental assistance program, in my opinion, is the most important thing for small private landlords who are family housing providers," Wong said.

Both tenants and landlords must fill out certain parts of the online application, available on the California state website Housing is Key.

The first group of eligible renters are the most needy: households earning 50% or less of the area median income, or anyone who has been unemployed for at least 90 days.

The next group includes households earning 80% or less than the area median income. Undocumented renters are also eligible.

Urban Institute data show that, across the United States, less than one-third of renters and less than half of private landlords are aware of federal rental assistance programs. So John Wong aims to disseminate information about rental assistance programs to individual landlords, especially those who may be isolated because of poor language skills.

"Personally, I focus a lot on making sure that non-native English speakers have access to the information that these funds are available," Wong said.

The way rent assistance works is that the 80% of rent owed by the tenant between 1 April 2020 and 31 March 2021 will be paid directly to the private landlord, provided that the private landlord agrees to forgive the remaining 20% of rent arrears.

But this new rent assistance program does not distinguish between small private landlords and large corporate landlords. For individual landlords like Jie Wang, having to absorb that remaining 20% of unpaid rents can be a crushing blow after a year of missed rent payments.

"I am willing to rent to low-income tenants," said Jie Wang. "As long as I can survive, I will be given all the tools to help me survive this difficult situation.