Starting this Saturday, February 1, all products entering the United States from Mexico and Canada will have a tariff rate of 25 percent, while for those arriving from China it will be 10 percent, the White House reported in a statement, thus fulfilling the threats announced by Donald Trump since his presidential campaign.

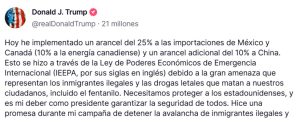

The announcement was followed by a message from President Trump on the social network Truth Social, where he stated that he had taken the measure in response to the “great threat” posed by immigration and the entry of drugs into the country.

“Today I implemented a 25% tariff on imports from Mexico and Canada (10% on Canadian energy) and an additional 10% tariff on China. This was done through the International Emergency Economic Powers Act (IEEPA) because of the great threat posed by illegal immigrants and the lethal drugs that kill our citizens, including fentanyl,” Trump wrote.

“We need to protect the American people, and it is my duty as president to ensure everyone’s safety. I made a promise during my campaign to stop the flood of illegal immigrants and drugs crossing our borders, and Americans voted overwhelmingly to do so,” he concluded.

The fact sheet issued by the White House states that the imposition of tariffs on imports from Canada, Mexico and China seeks to address “the extraordinary threat posed by illegal aliens and drugs, including deadly fentanyl, which constitute a national emergency under the International Emergency Economic Powers Act (IEEPA).”

The document explains that tariffs will be reduced until “the crisis is alleviated.”

The flow of smuggled drugs such as fentanyl into the United States through illicit distribution networks has created a national emergency, including a public health crisis, he said.

The report said Chinese officials have not taken the necessary measures to stop the flow of chemical precursors to known criminal cartels and to stop money laundering by transnational criminal organisations.

He added that Mexican drug trafficking organizations have an “intolerable alliance with the Mexican government,” while it has offered refuge to cartels to dedicate themselves to the manufacture and transportation of dangerous narcotics.

"This alliance endangers the national security of the United States, and we must eradicate the influence of these dangerous cartels," the text stresses.

Likewise, it highlights that there is also a growing presence of Mexican cartels operating fentanyl and nitazene synthesis laboratories in Canada, and that a recent study recognized the increased national production of this synthetic opioid and its growing footprint within the international distribution of narcotics.

“Previous administrations failed to take full advantage of America’s economic position as a tool to secure our borders against illegal migration and combat the scourge of fentanyl, preferring instead to let problems fester. Access to the U.S. market is a privilege. The United States has one of the most open economies in the world and the lowest average tariffs in the world,” he said.

In light of these facts, the economist, columnist, communicator, American politician and professor of Public Policy at the University of California at Berkeley, Robert Reich, has pointed out on multiple occasions the damage that these tariffs will do to American society, especially to the working class and the most vulnerable.

“Tariffs are not paid by other countries. In the end, we pay them at the cash register. And they are regressive: they take a larger percentage of workers' salaries than those of the rich,” said the writer.

Reich further explained that a recent analysis found that when Trump imposed tariffs during his first term, companies that contributed to Republicans were more likely to get tariff exemptions. “Trump’s corporate donors will not bear the cost of his trade wars. It’s crony capitalism at its worst.”

In a video made just four months ago by Reich, the economics expert details that Trump seems genuinely confused about what tariffs are and who pays for them.

“Tariffs are not paid by other countries, they are paid by the American importer at the cost, which is usually passed on to American consumers. The tariff is a sales tax. Now, specific tariffs on specific products can give products made in the United States an advantage over imports, but there is no strategy behind the wave of tariffs,” he said.

The tariffs, he noted, would cost the average family an estimated $2,500 more per year. “This is a regressive tax that takes a larger share of the wages of the working class and the poor than it does of the incomes of the rich,” he said.

And it is American companies that pay the costs, by paying the tariffs imposed on the goods they buy in those markets, which could be devastating for Americans.

Trump called “tariff” “the most beautiful word in the dictionary” during the election campaign, repeatedly saying that imposing high tariffs on foreign goods would boost the U.S. economy, a claim that many economists question.

“The economic consequences of such tariffs would be severe for North America and could cause significant disruptions to growth and trade relations,” said Julian Hinz, director of trade policy research at the Kiel Institute for the World Economy.

The Peterson Institute for International Economics said the 25 percent tariffs on Canadian and Mexican products would hurt all three North American countries and, over time, cause some prices to rise in the United States.

On Friday morning, Mexican Economy Secretary Marcelo Ebrard reported that the imposition of a 25 percent tariff on Mexican exports would seriously affect consumers through higher prices, reduced product availability and possible disruptions in supply chains.

These effects would mainly affect products such as automobiles; Mexico is the main supplier of automobiles and auto parts to the United States, and the tariffs would harm 12 million families and cause strong inflationary pressures.

Likewise, computers; the impact of tariffs on Mexican computers would affect 40 million families in the United States, since Mexico is the fifth largest supplier of this device in the country.

Also, in the case of televisions, in the United States, 1 in 2 screens is of Mexican origin, and the increase in tariffs would affect 32 million families.

In the case of refrigerators, 1 in 3 purchased in the United States comes from Mexico, so 5 million families would be affected by this measure, which would represent an additional outlay of 817 million dollars.

In addition, these tariffs will also affect the pockets of American families with an increase in the price of products such as: fruits, vegetables, meat and beer.

The greatest impact will be in the country's border states, where consumption of Mexican products is highest.

You may be interested in: API leaders in Atlanta stand with Latino community after ICE raids