«La mejor forma de robar un banco, es ser dueño de uno», reza un dicho popular que pareciera cobrar un sentido particular con algunas acciones de Bank of America ‒BofA‒ denunciadas por integrantes de nuestra comunidad latina a Península 360 Press ‒P360‒.

José Alcalá, quien vive en Antioch, California, recibió un bono navideño de 5 mil dólares en el trabajo, los cuales depositó a su cuenta en Bank of America. Esperaba que los fondos estuvieran disponibles al día siguiente, como regularmente ocurre. Sin embargo, con sorpresa y frustración se percató de que BofA había bloqueado el capital por 10 días.

Alcalá se puso en contacto con representantes de BofA, éstos le notificaron que el bloqueo de sus fondos era una medida que el banco estaba tomando para proteger a sus clientes de posibles fraudes o cheques sin fondos.

No obstante, Alcalá contactó a su jefe en el trabajo y éste le notificó que BofA ya había cobrado el cheque.

P360 ha podido documentar que el de Alcalá no es un caso aislado, ya que BofA ha retenido el dinero de otros clientes.

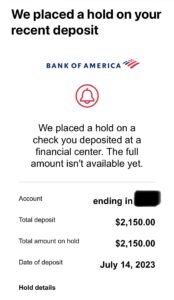

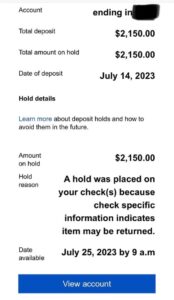

Otro residente de Redwood City, identificada como «Pérez», dijo a P360 que BofA le retuvo dos mil 150 dólares de su cuenta de cheques para, supuestamente, «protegerlo por si el cheque con el que le habían pagado, correspondiente a un mes de su trabajo, no tenía fondos».

.

Pérez ha sido cliente de BofA por los últimos 30 años y el cheque que depositó, del cual le retuvieron los fondos, corresponde al de una persona con quien ha trabajado por más de 20 años. «Esto de que Banco de América me impida usar mi dinero, supuestamente para mi propia protección, no tiene sentido. Es muy frustrante, porque de ese dinero depende mi familia».

Consultado por P360, el economista Joaquín Alfonso Ortiz, dijo desconocer este procedimiento de retención de dinero por parte de BofA. No obstante, dijo, la gente ha señalado que el dinero que les está siendo retenido, podría significar un jugoso negocio para el banco.

Ortiz, egresado de la Universidad de Berkley, comentó que la Reserva Federal de Estados Unidos aumentó recientemente los intereses para préstamos de dinero, por lo que «si un banco les retuviera 2 mil 500 dólares a 400 clientes, estaríamos hablando de un millón de dólares, de los cuales el banco tendría el control de manera gratuita por diez días».

«Imagínate la frustración de saber que llevas 15 días o un mes de trabajo y el banco te retiene tu dinero por diez días con el pretexto de que te quieren proteger, ¿qué comes mientras tanto?», comentó en entrevista a P360 Berta Solís, a quien BofA recientemente le puso un bloqueo de 10 días a un cheque por 3 mil dólares, que era el sueldo de su marido como profesor.

Para Alcalá, resulta difícil creer que, en una época digital, donde las transferencias bancarias se realizan en segundos, BofA recurra a esas retenciones de dinero por tanto tiempo. Él, como otras personas de la comunidad latina entrevistadas en el marco de este reportaje, se dijeron indignadas por lo que está haciendo BofA.

Ortiz resaltó como dato que BofA excedió en 19 por ciento las expectativas de ingreso en el segundo trimestre de 2023, lo que se tradujo en un incremento de sus ganancias por 1.2 billones más este trimestre, que el mismo periodo del año pasado.

El pasado 11 de julio, la agencia de noticias AP informó que BofA deberá reembolsar 100 millones de dólares a sus clientes por hacerles cargos extras de manera irregular, razón por la que la institución bancaria fue multada con 90 millones de dólares por parte de la Oficina de Protección Financiera del Consumidor ‒CFPB, por sus siglas en inglés‒, así como 60 millones a la Oficina del Contralor de la Moneda.

«Banco de América retuvo indebidamente las recompensas de las tarjetas de crédito, duplicó las tarifas y abrió cuentas sin consentimiento», dijo el director de CFPB, Rohit Chopra, de acuerdo con AP. «Estas prácticas son ilegales y socavan la confianza del cliente».

De acuerdo con el sitio web de Bank of America, la retención les da tiempo ‒y al banco que paga los fondos‒ para validar el cheque, lo que puede ayudar a evitar posibles cargos en caso de que un cheque depositado se devuelva sin pagar.

«Pero tenga en cuenta que un cheque se puede devolver sin pagar después de que los fondos se hayan puesto a su disposición», indica la institución bancaria.

Agrega que, de ser retenido un depósito, el banco informa vía cajero automático, en el centro financiero, vía móvil, alerta por correo electrónico, o por correo tradicional, todo depende de cómo se haga el depósito.

BofA precisa que «las retenciones de depósitos suelen durar entre 2 y 7 días laborables, dependiendo del motivo de la retención. Para los depósitos realizados los fines de semana, los fondos se consideran depositados el lunes ‒el primer día laborable‒, por lo que la retención entrará en vigor el siguiente día laborable ‒martes‒.

En algunos casos, detalla, el período de retención puede variar como resultado de nueva información que reciban o descubran, y de ser así, se notificará inmediatamente por correo postal y/o correo electrónico.

Te puede interesar: Hasta 30% de las remesas que llegan a México son de mujeres, quienes emigran cada vez más