"The best way to rob a bank is to own one," goes a popular saying that seems to make a particular sense with some Bank of America ?BofA? denounced by members of our Latino community to Peninsula 360 Press ?P360?.

José Alcalá, who lives in Antioch, California, received a $5,000 Christmas bonus at work, which he deposited into his Bank of America account. I expected the funds to be available the next day, as they regularly are. However, to his surprise and frustration, he realized that BofA had blocked the capital for 10 days.

Alcalá contacted representatives of BofA, they notified him that the blocking of his funds was a measure that the bank was taking to protect its clients from possible fraud or bad checks.

However, Alcalá contacted his boss at work and was notified that BofA had already cashed the check.

P360 has been able to document that the one in Alcalá is not an isolated case, since BofA has withheld money from other clients.

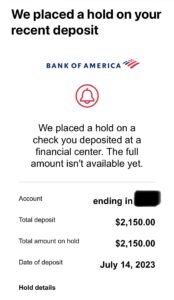

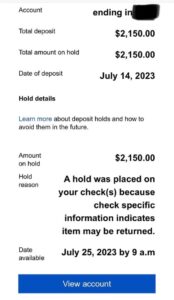

Another Redwood City resident, identified as "Pérez", told P360 that BofA withheld $2,150 from his checking account to, supposedly, "protect him in case the check with which they had paid him, corresponding to a month of his work, he had no funds.

.

Pérez has been a BofA client for the last 30 years and the check he deposited, from which the funds were withheld, corresponds to a person with whom he has worked for more than 20 years. “This thing about Bank of America preventing me from using my money, supposedly for my own protection, doesn't make sense. It's very frustrating, because my family depends on that money."

Consulted by P360, the economist Joaquín Alfonso Ortiz, said he was unaware of this procedure withholding money by BofA. However, he said, people have pointed out that the money being withheld could mean a lucrative deal for the bank.

Ortiz, a graduate of the University of Berkley, commented that the United States Federal Reserve recently increased interest rates for money loans, so "if a bank withheld $2,500 from 400 customers, we would be talking about a million dollars." , of which the bank would have control free of charge for ten days.”

"Imagine the frustration of knowing that you have been working for 15 days or a month and the bank withholds your money for ten days under the pretext that they want to protect you, what do you eat in the meantime?" Berta Solís commented in an interview with P360, to whom BofA recently placed a 10-day block on a check for $3,000, which was her husband's salary as a teacher.

For Alcalá, it is hard to believe that, in a digital age, where bank transfers are made in seconds, BofA resorts to holding these money for so long. He, like other people from the Latino community interviewed in the framework of this report, said they were outraged by what BofA is doing.

Ortiz highlighted as data that BofA exceeded revenue expectations by 19 percent in the second quarter of 2023, which translated into an increase in its profits of 1.2 billion more this quarter, than the same period last year.

On July 11, the AP news agency reported that BofA must reimburse its customers 100 million dollars for making extra charges irregularly, which is why the bank was fined 90 million dollars by the Bureau. of Consumer Financial Protection? CFPB, for its acronym in English?, as well as 60 million to the Office of the Comptroller of the Currency.

"Bank of America improperly withheld credit card rewards, doubled fees and opened accounts without consent," CFPB Director Rohit Chopra said, according to AP. "These practices are illegal and undermine customer trust."

According to the Bank of America website, withholding gives them time? And the bank that pays the funds? to validate the check, which can help avoid potential fees if a deposited check is returned unpaid.

"But keep in mind that a check can be returned unpaid after the funds have been made available to you," says the banking institution.

He adds that, if a deposit is withheld, the bank informs via ATM, in the financial center, via mobile, email alert, or by traditional mail, it all depends on how the deposit is made.

BofA specifies that “deposit withholdings usually last between 2 and 7 working days, depending on the reason for the withholding. For deposits made on weekends, funds are considered deposited on Monday ?the first business day?, so the hold will take effect on the next business day ?Tuesday?.

In some cases, it details, the retention period may vary as a result of new information they receive or discover, and if so, they will be notified immediately by postal mail and/or email.

You may be interested in: Up to 30% of the remittances that arrive in Mexico are from women, who emigrate more and more