Listen to this note:

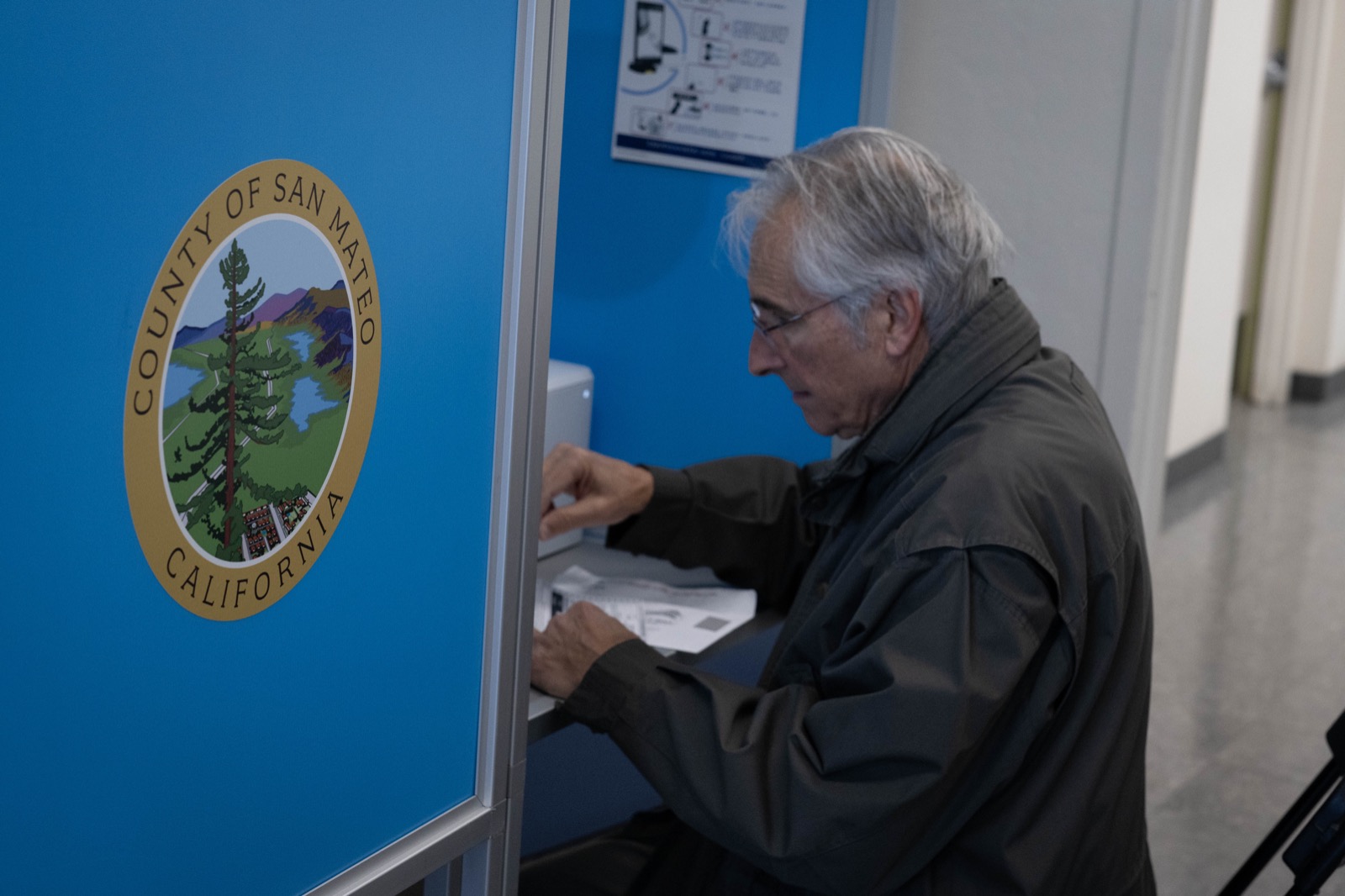

All citizens registered to vote in the San Mateo County This March 5, you will have to choose between voting yes or no to Measure B, which has to do with the adoption of a special tax for the county service area that, if adopted, would raise up to $90,000 annually for police and fire protection.

And on November 7, 2023, the San Mateo County Board of Supervisors adopted a resolution to renew the collection of a special tax on property located in County Service Area No. 1 (“Service Area”), which, if approved, will raise up to approximately $90 thousand annually for expanded police and fire protection services.