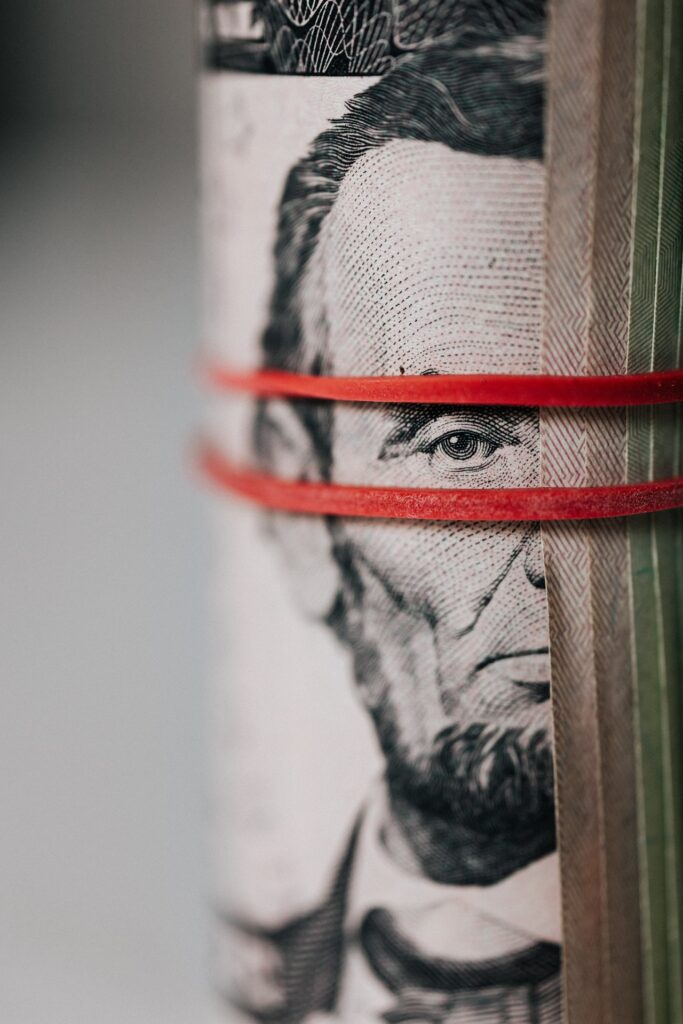

Venture capital has increasingly become the lifeblood of the American entrepreneurial spirit. Yet of the $161 billion in venture capital invested in the U.S. in 2020, Black, Latino, and women-founded companies accounted for a paltry share. Data from Crunchbase, a platform that tracks venture capital, shows that $161 billion in venture capital invested in the U.S. in 2020 is the largest share of venture capital.